When to Expect a Hard Credit Check

When to Expect a Soft Credit Check

When to Expect a Hard or Soft Credit Check

HARD CHECK

* Applying for a credit card

* Applying for a loan (personal, mortgage, car, business, etc.)

* Getting a cell phone contract

* Requesting a credit line increase

SOFT CHECK

* Loan and credit card pre-approval letters

* Checking your own credit score

* Employer background checks and other background checks

* Getting an insurance policy (life, renters, car, homeowners, etc.)

HARD OR SOFT CHECK

* Apartment rental applications

* Opening a checking or savings account

* Getting a cable or utility account

* Identity verification by financial institution

Unlike a hard credit inquiry a soft credit inquiry wont affect your FICO® Score.

What Is a Good FICO® Score?

FICO® creates different types of consumer credit scores. There are “base” FICO® Scores that the company makes for lenders in multiple industries to use, as well as industry-specific credit scores for credit card issuers and auto lenders.

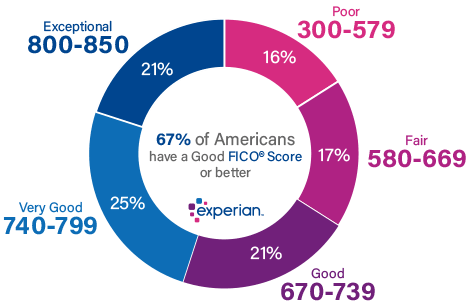

The base FICO® Scores range from 300 to 850, and FICO defines the “good” range as 670 to 739. FICO®‘s industry-specific credit scores have a different range—250 to 900. However, the middle categories have the same groupings and a “good” industry-specific FICO® Score is still 670 to 739.

What Is a Good VantageScore?

VantageScore’s first two credit scoring models had ranges of 501 to 990. The two newest VantageScore credit scores (VantageScore 3.0 and 4.0) use a 300 to 850 range—the same as the base FICO® Scores. For the latest models, VantageScore defines 661 to 780 as its good range.